If you’re considering a career in real estate, one possible choice is becoming a mortgage broker. What does a mortgage broker do, you ask? Well, mortgage brokers work for clients (who are looking to purchase either private residences or commercial property) to research, find, and secure the best mortgage interest rate and loam terms. Interest rates are ever-changing, so the research is ongoing.

Qualifications For a Mortgage Broker

What are some qualifications that are useful when becoming a mortgage broker? As will most jobs, proficient verbal and written skills, as well as well-rounded personal skills are must-haves. A good grasp of math, especially with financial, sales, and marketing concepts is also a must-have. You have to be able to explain financial concepts to your clients, as well as have a familiarity with credit and lending. Because you will be seeking clients, it’s also really helpful to have an outgoing personality.

It’s also very important to note that being a mortgage broker can call for long hours in search of lenders for clients. It is also not typically a Monday through Friday, 9 to 5 job, as most of your clients are not going to be available for the day as they will often be at work. In other words, mortgage brokers have to be accommodating with their clients’ schedules.

Its All About Effort

Sadly, this is not a job you can just get if you try hard enough—you have to have a high school diploma, 20 hours of training, and a good foundation of knowledge in the finance and economics world. It would even be helpful to have a base of accounting and law knowledge. For that last one, there are many opportunities to improve your knowledge base with online courses.

What About a Salary?

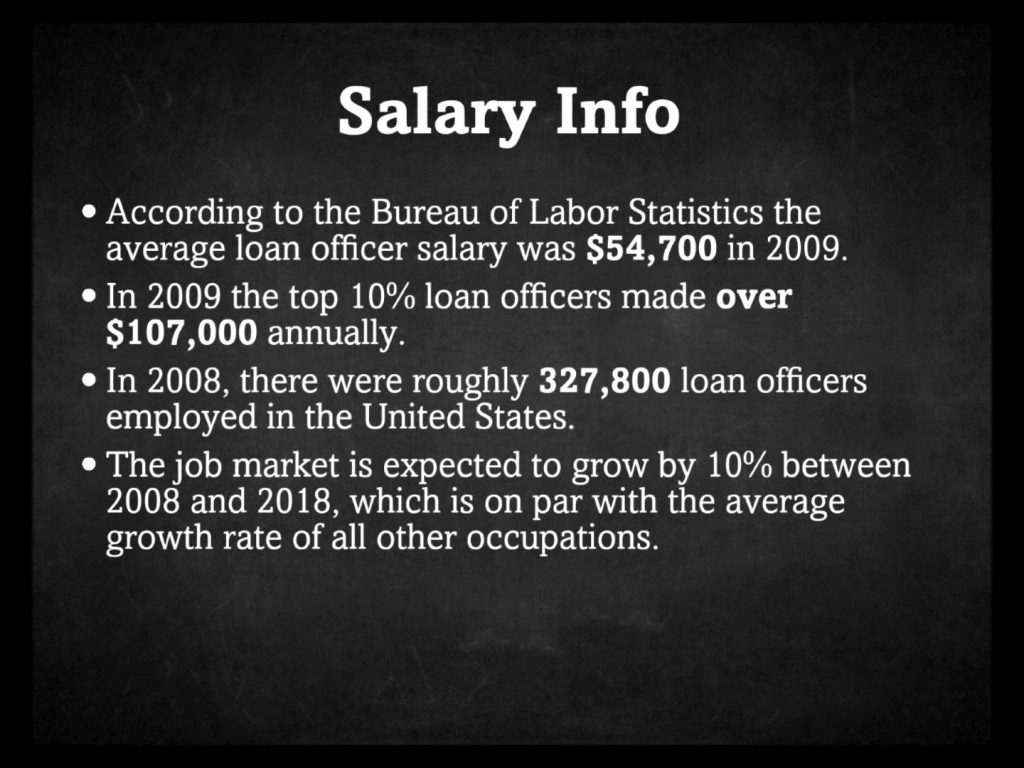

So how do mortgage brokers make money? Depending on whether you work independently or for a firm, you may or may not earn a salary as a mortgage broker. There is additional compensation based on the mortgages and loans you are able to secure for your clients. Starting out, you might not bring in as much as an experienced broker. Mortgage broker salaries (depending on location, experience, success, and if you are a mortgage broker or a loan officer etc.) can range anywhere from low $30,000 a year to near $80,000 a year. Again, dependent on location and success, you can earn commissions upwards of $100,000 in addition to that salary.

Getting Your Mortgage Broker License

So how do I become a mortgage broker? Well, the industry is heavily regulated and each state is going to have its own requirements for this. First thing, in every state, you have to get your mortgage broker license and bonded. The exam is given by the National Mortgage Licensure System (NMLS), and is called the SAFE Mortgage Loan Originator Test.

So how do I become a mortgage broker? Well, the industry is heavily regulated and each state is going to have its own requirements for this. First thing, in every state, you have to get your mortgage broker license and bonded. The exam is given by the National Mortgage Licensure System (NMLS), and is called the SAFE Mortgage Loan Originator Test.

This exam has state-specific questions, as well as a large portion of national regulation questions. There are many resources online to help with exam prep.

Important to note, the mortgage broker exam fees are a fixed amount for all brokers regardless of which state you are in. The national component costs $110, and the state component is $69.

Assuming you’ve passed the exam and gotten your mortgage broker license, many states in the U.S. require that you also obtain a broker bond. What is a broker bond? It’s a type of surety bond that acts as a protection for your clients (the future homeowners) in the case that you are found to be doing business fraudulently. Which, of course, you won’t… right?

The bond works the same as insurance does—you pay an annual premium to be covered for a certain state-required amount. The cost you’ll pay depends partly on the amount of the bond and your credit score.

Sounds Tough Doesn’t It?

Still interested? Great! So take some time to research the specific requirements in your state for becoming a licensed and bonded mortgage broker. Make sure that you complete all of the requirements, pass that exam, and you’re on your way to a successful and fulfilling career in real estate as a mortgage broker.

Congratulations, now you are licensed and bonded to be a mortgage broker in your state. Don’t forget, you have to renew your license and bond annually, and in most states even have to take required continuing education hours. Also not to be forgotten is that if you are planning to operate in multiple states, you have to have a license for each of them—that can add up!

Recent Articles